IIFL Finance share price fell by 35% in last 2 days after actions taken by RBI will it affect the profitability of the company.

After the Reserve Bank of India took action against IIFL Finance share price of IIFL Finance fell 35% in last 2 days and reached its lowest point of previous 17 months. RBI requested that IIFL immediately stop authorizing or disbursing gold loans, as well as assigning, securitizing, or selling any of its gold loans. Nonetheless, the business may carry on managing its current portfolio of gold loans using standard procedures for recovery and collection.

1. Actions taken by RBI on IIFL Finance

The Wednesday session on June 3, 2024 IIFL finance share price, had high and low values of 382.20, indicating that the stock price had already entered the lower circuit.

- Reserve Bank of India found the following as a result of its inspection.

- Differences in assaying and certifying purity and net weight of the gold.

- breaches in Loan-to-Value ratio.

- A considerable disbursal and collection of loan amount in cash far in excess of the statutory limit;

- Failure to comply to the standard auction process

- lack of transparency in charges being levied to customer accounts

2. If restrictions continued, how will it affect IIFL Finance gold loans business.

IIFL finance provides range of products like Home loan, Gold loan, Business loan, Microfinance, capital market finance and developer &Construction finance.

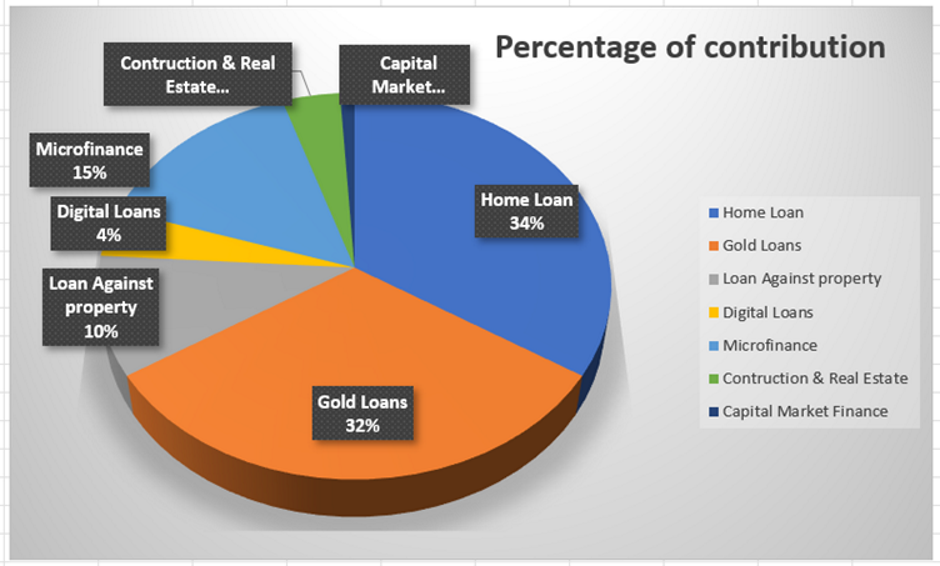

As on March 31, 2023 company has the following loan services and gold is a major contributor to companies’ business. Please see the figure below it shows Gold loan has contributed 32% of its overall services. This may affect the company’s profitability as a part of actions taken from RBI in the upcoming quarter or years.

3. Last quarters financial results

In the last quarter IIFL reported revenue of 2,647 crores, with interest of 988 crores and expenses of 945 crores. This gives the financing profit of 714 crores, with all this company has reported a total profit of 545 crores after deducting all the taxes. We have to see how companies profitability affects after the actions from RBI and how will they plan to address it in the future.

4. How IIFL Finance share price reacted in the week.

On the 4th of March 2024 the IIFL Finance share price was trading with bearish sign, next day it opened with a lower circuit at 478 price and no buyers were interested in buying, The same situation were seen on 6th of March and it continued the lower circuit. However on 7th March it showed a high volume of buyers and touched a high of 417.95 with higher circuit.

The Reserve Bank of India (RBI) has been proactive in its conversations regarding detected flaws with the company’s statutory auditors and top management in recent months. As a result of these cooperative efforts, significant corrective actions have not yet been put into effect. As a result, the RBI has decided that prompt action is necessary to resolve the issue and protect the general interests of the consumers.

To rectify the found weaknesses, the RBI has been actively involved with the relevant parties during this time, including the company’s auditors and leadership. It has been troubling that there hasn’t been any significant progress in fixing the stated shortcomings despite these continuous talks and actions.

The RBI has made the decision to impose immediate business limitations due to the seriousness of the issue and the possible hazards it poses to customers. These limitations are required to protect the integrity of the financial system and lessen any potential negative effects. The RBI hopes to maintain clients’ protection and trust in the financial services the company offers by putting these measures into place.

Even while the implementation of business limits is a big step, it also shows how dedicated the RBI is to maintaining the highest standards of client safety and regulatory compliance. It sends a strong message about how seriously regulatory bodies take non-compliance and how important it is to respond quickly and forcefully when needed.

To sum up, the RBI’s move to impose business restrictions demonstrates its steadfast dedication to upholding the integrity and stability of the financial system while putting the needs and safety of its clients first.

Post Comment